Bitcoin solved the Byzantine Generals' Problem for transactions, but it never solved the Byzantine Generals' Problem for development. At a $2 trillion market cap, humanity's hardest money is controlled by a handful of developers with no systematic governance.

The asymmetry is stark: Bitcoin's technical consensus is bulletproof, but its social consensus is fragile. A handful of people with write access to the code repository control a $2 trillion project. This creates a single point of failure that threatens Bitcoin's future.

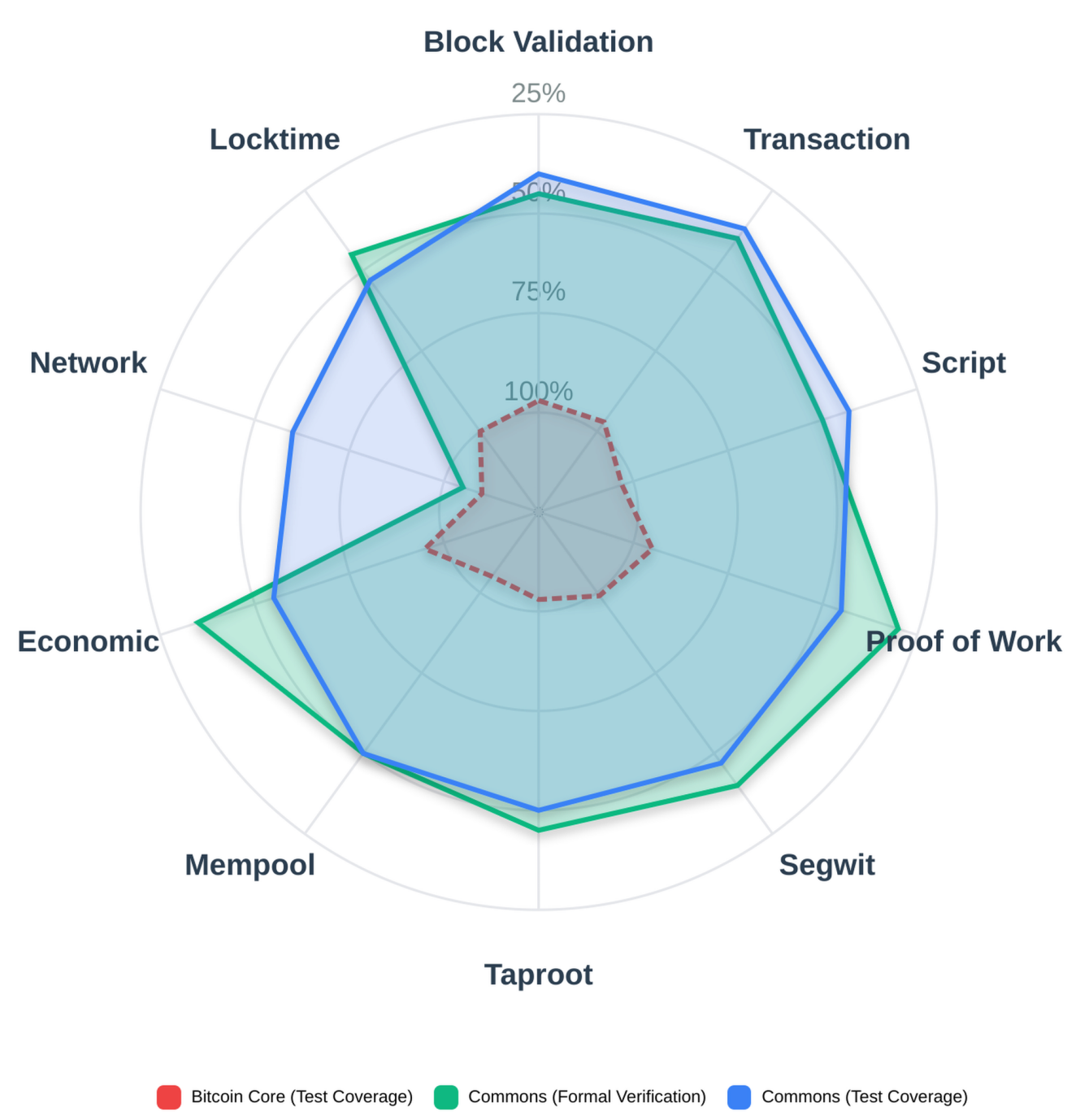

Gavin Andresen warned us about this in 2014. He said Bitcoin needed "three or four or five robust re-implementations" to give confidence that the system wouldn't have "some horrible bug that we manage to miss." But the governance problem had to be solved first.